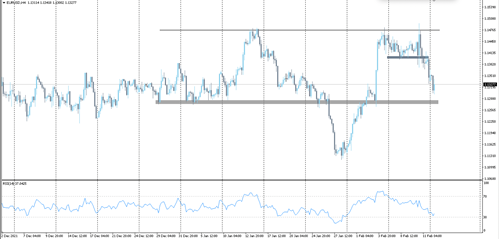

EURUSD

More than once, the EUR/USD pair attempted to surpass the resistance level of 1.1400, failure to defeat the mentioned level, a correction could happen where the prices may fall towards 1.1330-1.1280 levels.

However, if the pair could breach the 1.1400 resistance, it will likely continue rising towards 1.1480 levels.

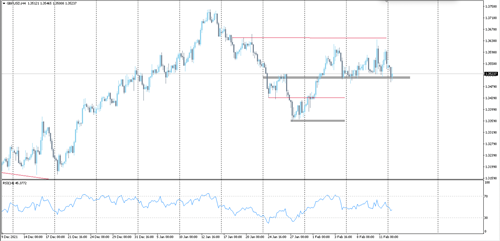

GBPUSD

the British pound succeeded in rebounding from the 1.3500 support level and rose to test the 1.3650 resistance once again. Successful follow-through could push the pair to 1.3700/1.3750 levels.

But if it fails to breach 1.3650, the decline will likely resume testing the support level for the pair 1.3500

USDJPY

The dollar-yen pair fell to test the 115.00 support level, and it is likely that by maintaining it, it will bounce back to the levels of 115.70-116.30.

But in case the 115.00 support is broken, the correction and decline will likely extend to 114.15 levels.

USDCHF

The dollar-franc pair is moving in a sideways range on the daily chart. After testing the upper boundary of the channel at 0.9350, it retraced from it, and the current decline is likely to extend the test to the 0.9090 support, which represents the lower boundary of the transverse channel.

The price resistance levels are 0.9270-0.9350.

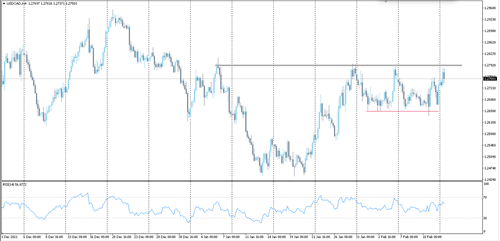

USDCAD

The USD/CAD pair fell from the resistance level of 1.2800, but it is still stable above 1.2650, which, if broken, the pair may extend the decline to the level of 1.2570.

But if the pair succeeds in surpassing the 1.2800 resistance level, this may contribute to the rise to 1.2860/1.2700 levels.

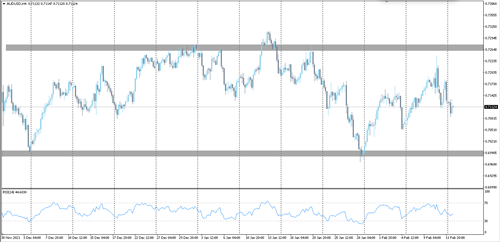

AUDUSD

The pair is moving within an ascending channel range and rebounded from the support level 0.7090, and the rise is likely to extend to levels of 0.7250 -0.7280.

Support levels for the pair are 0.7150-0.7080.

Gold

Gold prices successfully rose towards $1900, and by surpassing this level, the rise is likely to extend to the levels of 1910-1925.

Support levels for gold in case of correction from the current levels 1870-1850.

Silver

Silver is currently testing the $24.00 resistance level, by which it may extend the rise to 24.60 levels.

But in the event of a decline from the current levels, it may face the support levels 23.70-23.40.

Oil

Oil is moving within an ascending channel. After testing the upper limit around the resistance at $94.00, oil prices retreated and then tested the lower limit of the channel at $88.00. if the commodity continues to maintain trading above these levels, further bullish movement is expected towards 91.00-94.00.

But if the support 88.00 is broken, the decline will likely extend to levels of 85.50.

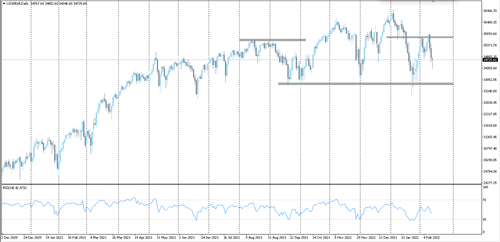

Dow Jones

The Dow Jones index succeeded in achieving the first bearish target at 34300, and the drop is likely to extend to 33600 levels.

But if the index succeeds in surpassing the 35000 resistance, the rise may extend to the 35700 level.

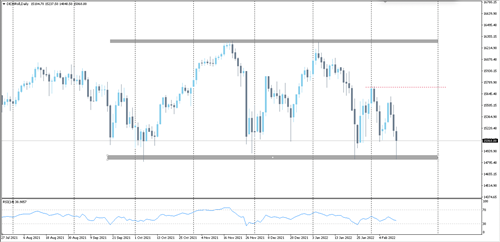

DAX

The German DAX index fell to the lower boundary of the horizontal channel 14800, and it is likely that by maintaining it, it will rebound to the upside to test it at 15700-16000 levels.

Support levels 14800-14500.