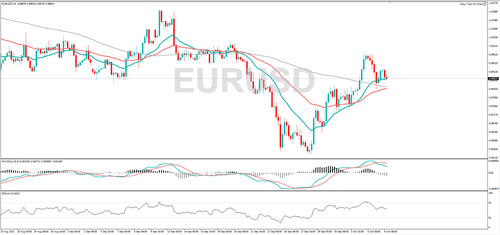

EUR/USD is trending higher, and if the rally continues, it might retest 0.9999 or 1.0049. RSI is falling and momentum has turned negative and that speaks to bearish sentiment. A fall from here could see it target 0.9877 or 0.9831.

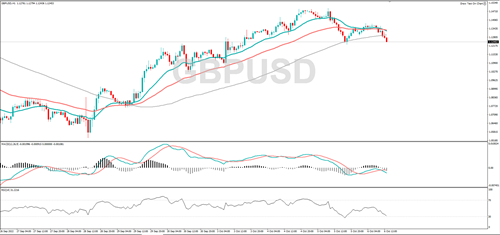

GBP/USD is edging lower, RSI is falling, and momentum has turned negative and that speaks to bearish sentiment. A decline from here could see it target 1.1226 or 1.1200. If the longer-term rally continues, it might encounter resistance at 1.1300 or 1.1368.

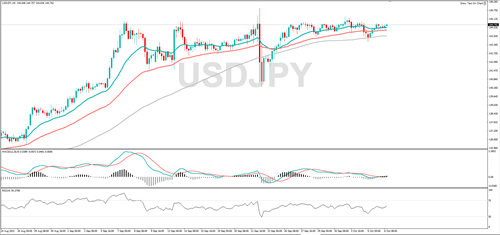

USD/JPY is edging higher, the momentum is increasing, and the RSI is moving higher, and that indicates bullish sentiment. If the rally continues, it could target 145.30 or 146.00. A fall from here could see it find support at 144.00 or 143.51.

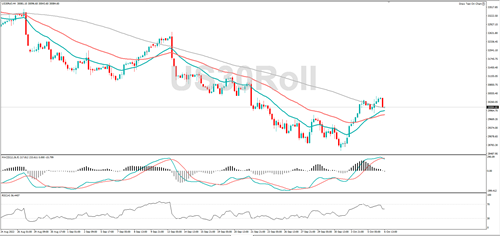

The Dow Jones is in an upward trend and if the bullish run continues, it might target 30455 or 31021. The RSI is moving lower, and momentum has turned negative, this speaks to bearish sentiment. A fall from here could see it target 30000 or 29819.

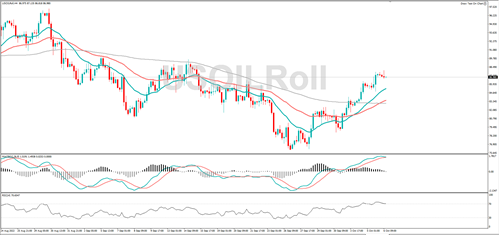

WTI is trending higher and if the bullish run continues, it could target 88.00 or 89.63. Positive momentum is fading, and the RSI is overbought, so that could be a sign a change in trend is in the offing. Support might be found at 84.83 or 83.42.

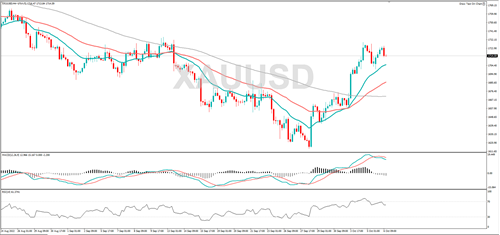

Earlier this week gold hit a three-week high and if the rally continues, it could target 1729 or 1735. The RSI is moving lower, and momentum has turned negative, this speaks to downbeat sentiment. Support might be found at 1712 or at 1700.

Silver pulled back from the three-month high that is posted on Tuesday. Resistance might be found at 20.69 or 21.23. The RSI is moving lower, and momentum has turned negative, this speaks to downbeat sentiment. Support might be found at 20.00 or 19.00.