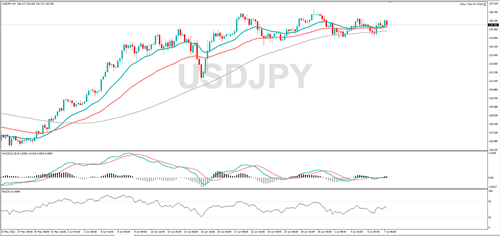

USDJPY

USD/JPY is in an uptrend and if the bullish run continues, it could target 137.00 or 138.00. It has yet to retest its 24-year high. A move lower from here could see it fall to 135.60 or 134.95.

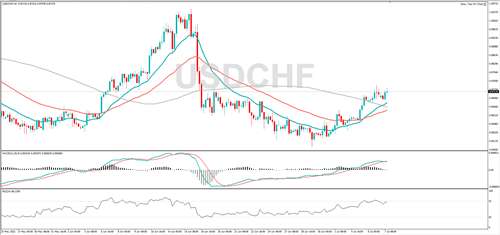

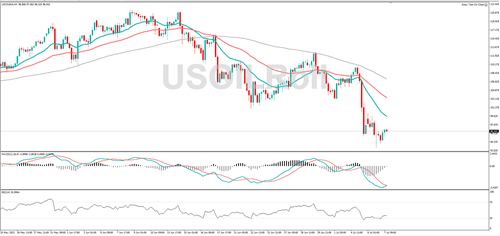

USDCHF

USD/CHF has been in a bullish trend since late June and if the upward move continues it might target 0.9816 or 1.000. A failure to move above 1.000, could see it turn lower, a decline from here could find support at 0.9640 or 0.9560.

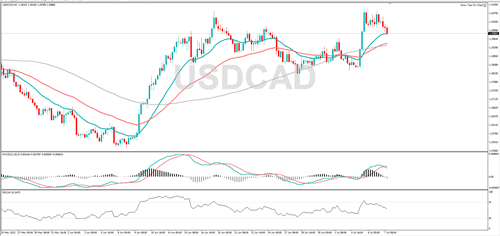

USDCAD

USD/CAD has retreated from a peak but while it remains above the 1.2936 mark, the wider uptrend should continue. 1.3100 or 1.3200 could act as resistance. A break below 1.2936 could see it fall to 1.2844.

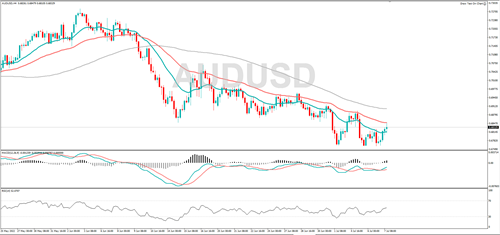

AUDUSD

AUD/USD recently fell to a 25-month low and while it holds below the 0.6894 level, the wider negative trend could continue. Support might be found at 0.6648 or 0.6519. A rally above 0.6894 could see it target 0.6963.

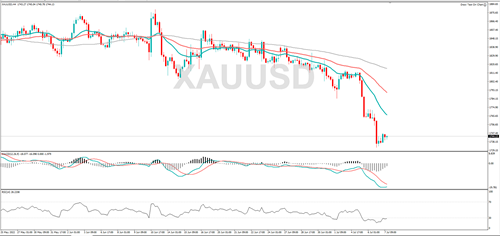

XAUUSD

Gold tumbled to its lowest mark since September 2021. The MACD indicator is in negative territory, suggesting the bears are in control. 1721 or 1700 could act as support. A rebound might bring 1769 or 1786 into play.

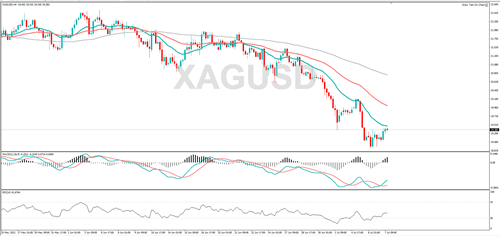

XAGUSD

Silver is in a downtrend and yesterday it dropped to its lowest level in over two years. If the bearish move continues, it might hit 17.93 or 16.94. A rebound might see it hit 19.90 or 20.20.

USOILRoll

WTI is in a bearish trend and if the broader negative move continues, it might encounter support at 92.61 or 89.56. A rally above 100.13 could pave the way for it to test 102.17.

US30Roll

The Dow Jones has been trading in a range lately. While it holds above the 30353 level, the short -term uptrend could continue, and resistance might be encountered at 31232 or 31883. A break below 30353 could see it target 30015.