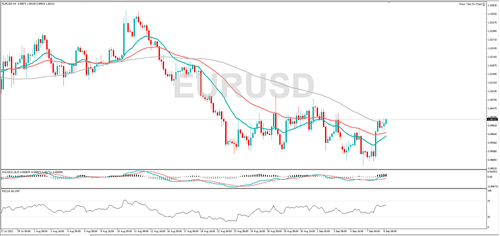

EUR/USD has rebounded from the 20-year low that was posted during the week. The RSI is rising, implying the price bias is to the upside. Further gains from here could see it hit 1.0032 or 1.0078. If the wider downtrend continues, it might target 0.9953 or 0.9882.

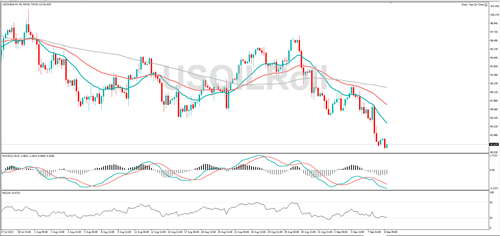

Yesterday, GBP/USD fell to its lowest level since 1985, and it is edging lower today. If the long-term bearish trend continues it might fall to 1.1404 or 1.1300. The RSI is in the middle of the range, suggesting there is no strong price bias in either direction. A rally from here could see it target 1.1538 or 1.1608.

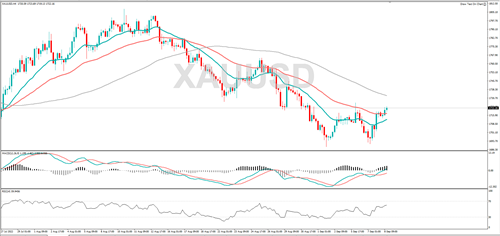

Gold is trending higher, positive momentum is growing and the RSI is rising, this indicates the upbeat mood. A break above 1726 could bring 1737 into the fold. If the longer-term bearish trend continues, gold could retest 1700 or 1696.

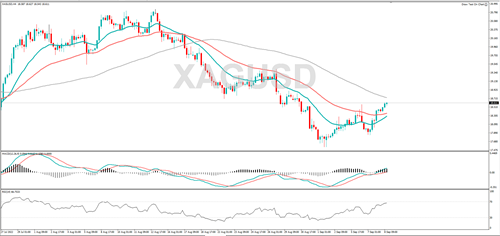

Silver hit its highest level in over one week, and momentum is in positive territory, suggesting the bulls are in control. 18.83 or 19.00 might act as resistance. The RSI is nearly in overbought territory, so that could be a sign the rally is on the cusp of being overstretched. A pullback could find support at 18.36 or 18.00.

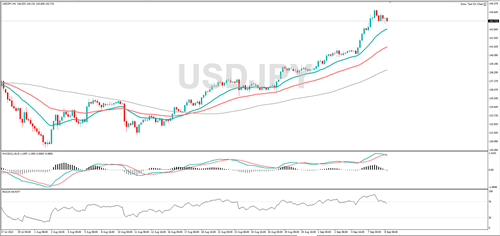

USD/JPY cooled from its 24-year high, and momentum is now negative, suggesting the sellers are dominating. If the wider rally continues, it might target 145.00 or 146.00. The RSI is no longer overbought, and that could be a sign the price bias is to the downside, a fall from here could see it hit 143.04 or 142.71.

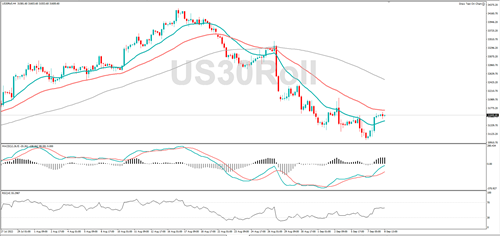

The Dow Jones recovered from the seven-week low posted yesterday. If the broader bearish move continues it might target 31395 or 31277. Momentum is positive and the RSI is rising, both speak to bullish sentiment. If the near-term rally continues, 31677 or 31700 might be targeted.

WTI fell to a new eight month low. RSI is falling and momentum is negative, implying bearish sentiment. If the downtrend continues, it might target 81.00 or 80.00. Should WTI rally from here, it might run into resistance at 82.68 or 84.17.