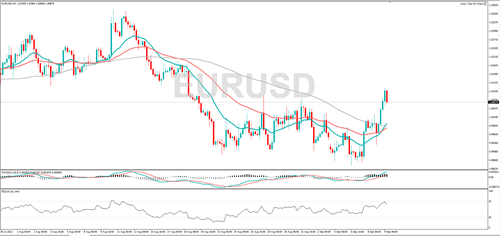

EUR/USD hit a three-week high and momentum is in positive territory, implying the bulls are in control. A break above 1.0112 could pave the way for 1.0171 to be tested. RSI is near overbought territory, which could be a sign a change in trend is in the offing. Support might be found at 1.0043, or 1.0000.

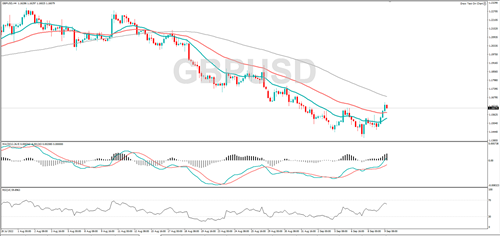

GBP/USD is trending higher and there is a steady rise in positive momentum, suggesting the buyers are dominating. A rally from here could see it target 1.1692 or 1.1759. If the wider bearish trend continues, it might find support at 1.1577 or 1.1539.

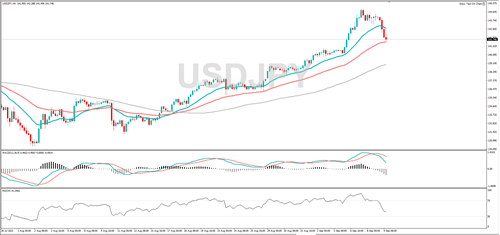

USD/JPY pulled back from the 24-year high posted on Wednesday. RSI is falling and negative momentum is increasing, both speak to bearish sentiment. Further declines from here could see it target 141.46 or 141.00. Should the long-term uptrend resume, it could hit 143.13 or 144.00

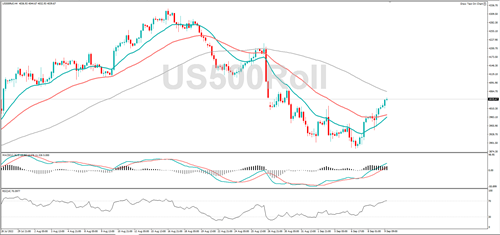

The S&P 500 hit a two-week high, and if the short-term rally continues, it might target 4070 or 4097. Positive momentum is fading, and the RSI is in overbought territory, this could be a sign a pullback is on the horizon. 4011 or 4000 could act as support should the market drop.

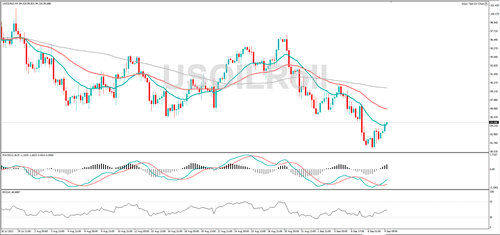

WTI is trending higher, and momentum is in positive territory, implying the bulls are in control. If the uptrend continues, 85.80 or 86.00 could act as resistance. Yesterday, WTI fell to an eight-month low, and if the broader bearish move continues, it might hit 83.00 or 82.00.

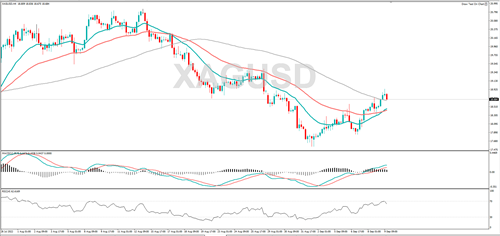

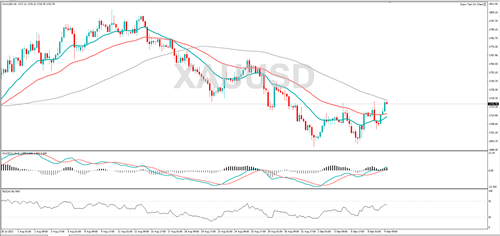

Gold hit its highest mark in over one week. The MACD indicator shows us that momentum is positive, suggesting the buyers are dominating. Resistance might be found at 1732 or 1737. RSI is close to being overbought, so that might be a sign the rally is overstretched. A drop from here could see it fall to 1718 or 1700.

Silver hit a two-week high, and if the bullish run continues, it might target 19.00 or 20.00. Positive momentum is fading, and the RSI is in overbought territory, this could be a sign a change in trend is on the horizon. A fall from here could see it target 18.51 or 18.00.