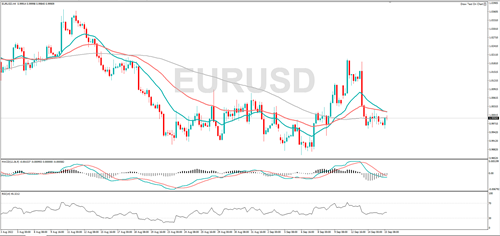

EUR/USD is trending lower, and momentum is in negative territory, suggesting the bears are in control. If the down trend continues, it might target 0.9954 or 0.9930. RSI is edging higher, implying the price bias is to the upside, resistance might be encountered at 1.0038 or 1.0100.

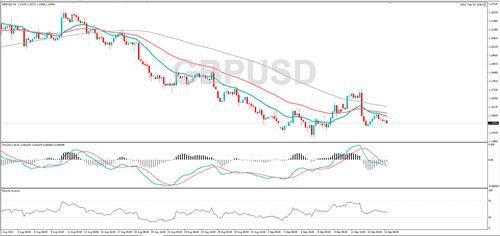

GBP/USD is moving lower, and momentum is in negative territory, suggesting the sellers are in control. If the negative trend continues, it might target 1.1459 or 1.1404. A rally from here might encounter resistance at 1.1580 or 1.1636.

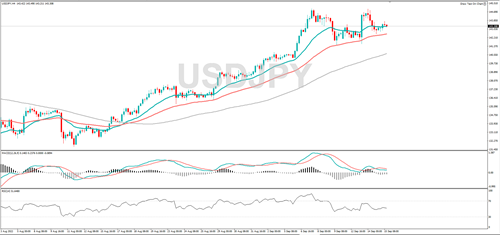

USD/JPY has pulled back from the 24-year high posted last week, but the long-term uptrend is intact. A rally from here, could see it hit 144.00 or 145.00. The RSI is dropping and that speaks to bearish sentiment. Support might be found at 141.59 or 140.84.

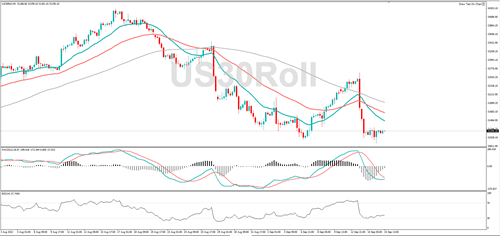

Yesterday, the Dow Jones fell to a two-month low. If the medium-term bearish trend continues, it might target 31039 or 30877. Negative momentum is falling, and the RSI is moving higher, that indicates positive sentiment. A rally could target 31502 or 31750.

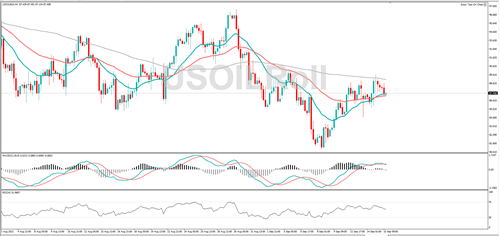

WTI is trending higher, and if the bullish move continues it might hit 88.64 or 89.63. Positive momentum is fading, and the that implies the bulls are running out of steam. A fall from here could see it hit 87.15 or 85.75.

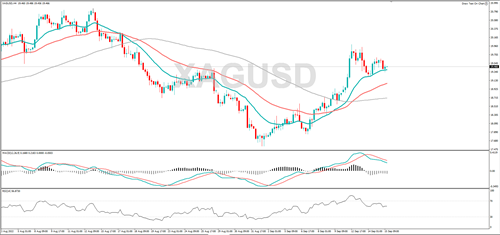

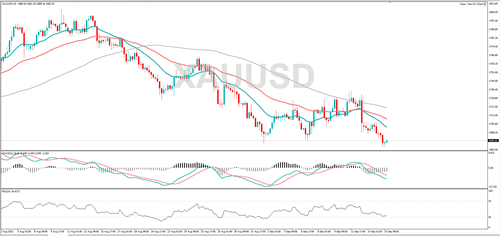

Gold is in decline. The MACD indicator shows us that momentum is negative, and the RSI is falling, this suggests bearish sentiment. A fall from here, could see it target 1680 or 1670. Should gold rebound, it might encounter resistance at 1700 or 1711.

Despite the sell off in the past 24 hours, silver remains in its wider uptrend, and if the positive move continues, it could target 19.68 or 20.00. The short-term trend is lower, and the RSI is falling, suggesting the price bias is to the downside. Support might be found at 19.22 or 19.04.