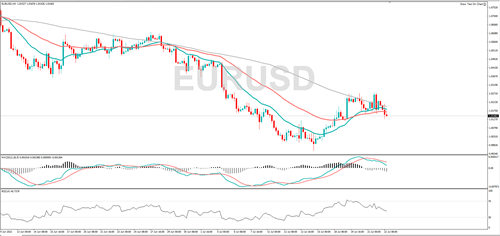

EUR/USD is edging lower and the MACD indicator shows that momentum is in negative territory, implying the bears are in control. A decline might see it find support at 1.0080 or 1.0027. A rally from here could see it target 1.0324 or 1.0400.

GBP/USD is moving lower, and so is the RSI, suggesting the price bias is to the downside. If the bearish move continues, it might target 1.1847 or 1.1759. Should the broader bullish move resume, it might hit 1.2045 or 1.2124.

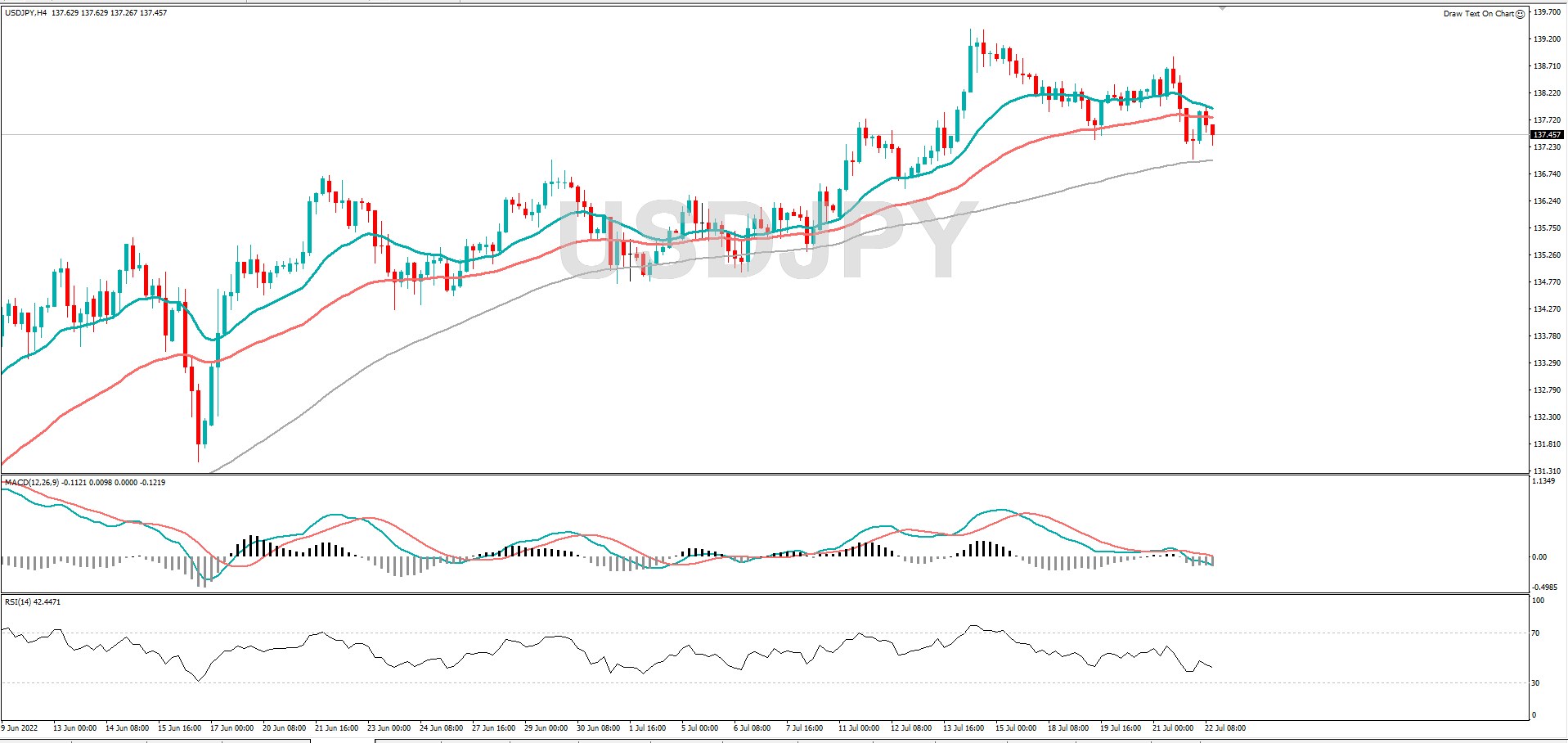

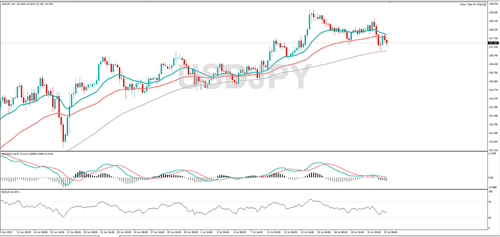

USD/JPY has fallen, and RSI is trending lower, suggesting the price bias is to the downside. A decline might find support at 137.00 or 136.46. If the wider rally resumes, 140.00 or 1.4100 might be targeted.

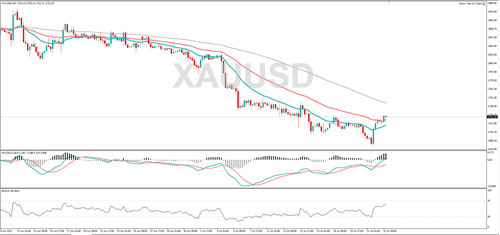

Yesterday’s daily candle on gold has the potential to be a bullish reversal, but the rally would need to continue for confirmation. Should the upward move continue, it might bring 1723 or 1745 into play. If the wider bearish move resumes, 1700 or 1678 could act as support.

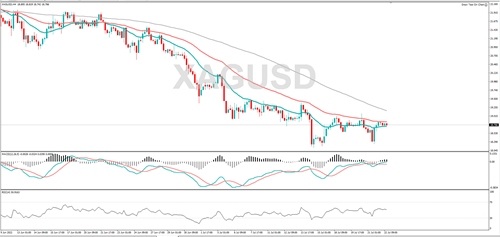

Silver is in a downtrend and last week it fell to its lowest level in over two years. If the bearish move continues, it might hit 18.22 or 18.13. A rebound might see it target 19.39 or 19.90.

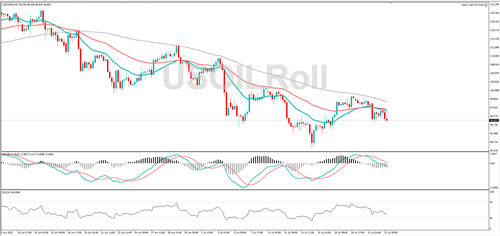

WTI is trending lower and so is the RSI, suggesting the price bias is to the downside. A further decline in price might find support at 91.60 or 90.00. A break above 100.00 could see it target 101.67 or 102.00.

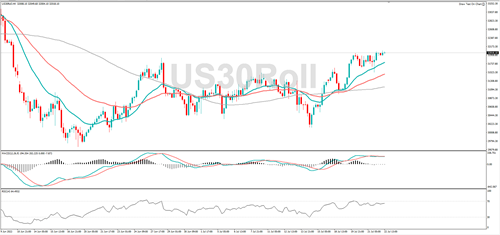

The Dow Jones hit its highest mark in over one month, if the rally continues, resistance might be found at 32347 or 32824. The MACD indicator shows that momentum has turned negative, suggesting the bears are dominating. A fall might find support at 31525 or 31149.