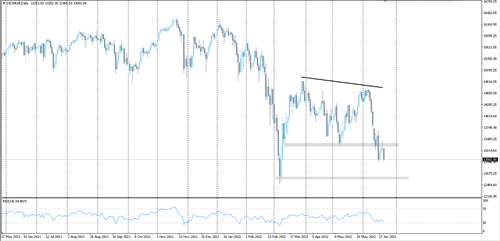

EURUSD

The EUR/USD pair is moving within a descending channel range and tested the support level of 1.0350 before rebounding back to 1.0515. The pair could edge higher and extend slightly to 1.0650.

If the pair moves back towards the support level of 1.0350 and breaches it, the slide will likely continue towards the level of 1.0200.

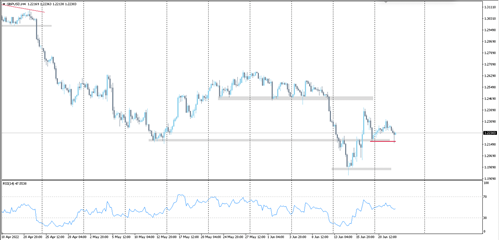

GBPUSD

The British pound fell to the support level of 1.2170 and succeeded in rebounding from it to the upside. If the pair could maintain trading above it, the rise could be extended to 1.2350-1.2460.

Failure to do so, the pair could move south towards the support level of 1.2170. A breakthrough may push the pair towards 1.2040-1.2000 levels next.

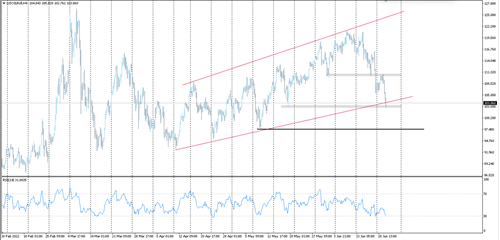

USDJPY

USDJPY bulls tested the resistance level of 136.70 and failed to breach it as the pair edged lower later on. The current correction will likely extend to test the support levels 135.40 - 134.50.

If the bulls took back control and defeated the resistance level of 136.70, the pair could continue its rally towards 137.50.

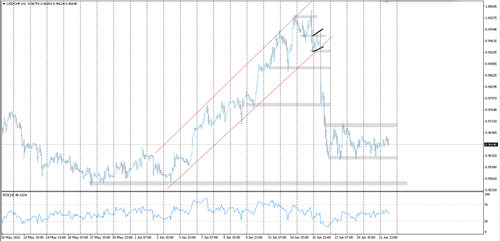

USDCHF

The pair formed a support level of 0.9620 and bounced back from that level. The pair will likely continue its bounce as bulls could face an immediate resistance near the levels of 0.9720.

Defeating the support levels of 0.9620 could prompt sellers to push the pair towards the level of 0.9550.

USDCAD

The pair bounced from the support level of 1.2900 and currently marching towards the resistance of 1.30. A fallow through beyond this level, the pair could edge higher towards levels of 1.3070.

A failure to defeat the mentioned resistance could give the bears the control where they might push the pair towards the support levels of 1.2900 and then next to 1.2850.

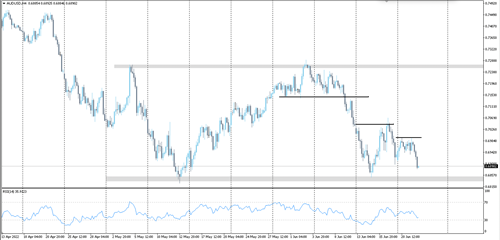

AUDUSD

The AUD/USD pair fell from the 0.7000 resistance as the decline is likely to extend to the level of 0.6840.

From the top side, if bulls were able to retake control, resistance levels awaits them near 0.6950 - 0.7000. a successful attempt to breach these levels may give more room higher towards the level of 0.7050.

Gold

Gold approached the support level of $1820, which is a strong support level. Failure to defeat the support level mentioned, gold prices could rebound higher, whereas bulls might test the resistance of $1843. A follow-through may result in prices reaching the level of $1858 next.

But if the support 1820 is broken, the decline may extend slightly to test the support level of $1804.

WTI

Oil retreated was able to defeat the levels of 106.00 support and edged lower towards the $103.00 level. If bulls were able to maintain trading above the 103.00, oil prices will likely rebound to the upside to test $106.00 again.

But if the 103.00 support is broken, this may contribute to an extension of the decline to levels of $98.00.

Dow Jones

The Dow Jones index is moving within a descending channel range and is now trading near the support level of 30000, which represents the lower boundary of the descending channel. A possible break of this level may force the index to extend the slide towards the level of 29500 and then 29000.

Resistance levels 30600 - 31000.

Dax30

The German DAX index declined to break the support of 13250 before bulls tried to restest it as a resistance level, but failed to breach it. Therefore, the drop is likely to extend to 12900 levels, which by breaking it may extend to 12600.

The resistance levels for the indicator are 13250 - 13400.